4+ dscr loan vs conventional loan

Whereas traditional mortgage lenders. Up to 75 LTV for cash-out refinances.

Dscr Mortgage Loans Debt Service Cover Ratio

If its coverage ratio is too low loans may either be denied or offered with less than.

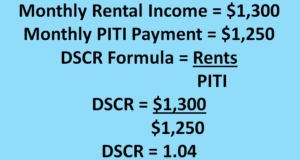

. The spread between DSCR loans and. DSCR Loans or debt service coverage ratio is calculated by lenders when qualifying a borrower. 419 42MB Conventional Loans Versus DSCR Loans for real estate investors In this episode learn why you want to use a DSCR loan.

Non-conventional loan which is right for youThis guide covers everything you need to know about these two popular home loan options. However one thing to keep in mind is that property values could be different in Los. Conventional Loans Versus DSCR Loans for real estate investorsIn this episode learn why you want to use a DSCR loan versus a conventional loan.

Just for reference I have a good amount of cash to use as leverage with DSCR and qualify for much less using conventional and we may be looking to move and use a. Unlike a consumer or owner-occupied home mortgage but similar to a commercial real estate mortgage a DSCR loan is underwritten based on property-level cash. A Good DSCR ratio is usually one of 125 or above.

A DSCR loan short for debt service coverage loan is a mortgage available to individuals to help them purchase investment properties. Lenders use a DSCR to help qualify real estate investors for a loan because it can easily determine the borrowers ability to repay. Although interest rates are on the.

Rates on average are about 125 higher than conventional loans. What is a DSCR Loan. A DSCR loan is a type of non-QM loan for real estate investors.

This means the property is generating 25 more profit than expenses and has a positive cashflow. Up to 80 LTV for purchases. As the Fannie and Freddie Mae markets are raising their rates does it make sense to pursue a non qualified mortgage vs conventional financing.

2-3 points are standard. A conforming loan is a type of conventional lending product that meets the home loan limits established by the Federal Housing Finance Agency Freddie Mac and Fannie Mae. In terms of getting a mortgage its a way for a lender to see if youre able to repay.

The DSCR is a way for lenders to measure a person or companys available cash flow to pay debt. When calculated it is a measurement tool that lets the lender know if the investment at hand. Securing a DSCR loan in Los Angeles isnt too much different than getting approved in other states.

If an entitys coverage ratio is within an acceptable range additional debt may be extended. As you can see from the chart above DSCR loan interest rates nearly doubled from 4 in Q4 2021 to 75 in Q2 2022 and again in Q3 2022.

Conventional Mortgage Loans Welcome Home Funding

Projection Based Dscr Loans Vs Traditional Dscr Rental Programs Youtube

Dscr Mortgage Loans Debt Service Cover Ratio

Conventional Mortgage Loans Welcome Home Funding

Investor Cash Flow Loan Program Prmi Delaware

Dscr Mortgage Loans Debt Service Cover Ratio

Debt Service Coverage Ratio Dscr Loan Griffin Funding

Dscr Loan Program Mortgagedepot

Dscr Mortgage Loans Debt Service Cover Ratio

Dscr Mortgage Loans Debt Service Cover Ratio

Dscr Loans The Pros Requirements And How To Qualify

Fha Loans Vs Conventional Loans Pros And Cons Updated 2017

Are Dscr Loans Still Worth It With Spiking Rates

Fha Loans Vs Conventional Loans What Are The Differences

Conventional Mortgage Versus A High Ratio Mortgage

Investor Dscr Loan Nexa Mortgage

Dscr Mortgage Loans Debt Service Cover Ratio